March 2025

Bering Waters Ventures is a strategic investment and advisory firm focused on supporting the next generation of blockchain innovators. Specializing in early-stage investments, we provide not only capital but also hands-on advisory, facilitate strategic partnerships, and help projects build relationships with investors—to ensure their success and scalability.

Our commitment extends beyond investment — we actively collaborate with our portfolio companies and broader market participants to drive sustainable growth and long-term impact, while contributing to the overall advancement of the blockchain industry in an evolving and competitive landscape.

Through this report, Bering Waters Ventures aims to contribute to the ongoing discourse on blockchain oracles, offering insights into their role, development, and the opportunities they present for decentralized ecosystems, traditional finance, and real-world asset tokenization.

Disclaimer

The organization that authored this report holds a position in RedStone Oracles, one of the oracles discussed in this report. Additionally, Bering Waters holds positions in Otonomi, Solana, Aave, and Synthetix, which are featured as examples to illustrate the use cases of oracles across different industries and ecosystems, such as parametric insurance, layer 1 blockchains, decentralized lending and borrowing, decentralized identity, and synthetic assets. Other than these ownership positions, the author of this report and the author’s organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report. The sources of the information and data cited in this report are considered reliable by the author, and certain verifications have been made for authenticity, accuracy, and completeness but the author makes no guarantee for the authenticity, accuracy, or completeness of the information and data cited in this report. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment, or other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report. Readers should not make business or investment decisions based on this report and must always use their independent judgments when making business and investment decisions. The information, opinions, and inferences contained in this report reflect the judgments of the researchers on the date of finalizing this report. The author undertakes no obligation to update this report following changes that might impact the opinions and inferences contained in this report. The copyright of this report is owned by Bering Waters Ventures. If you need to quote the content of this report, you must indicate the source. You may not quote, delete, or modify this report in a manner contrary to the original intent of the author.

Content

Note: All section titles in the table of contents are clickable for easy navigation. Click on any title to jump directly to the corresponding section.

- Introduction

1.1. Importance of Oracles in the Blockchain Ecosystem

1.2. Historical Context

1.3. What’s Ahead: A Preview of Oracle Insights - Understanding Blockchain Oracles

2.1. Mechanisms Behind Blockchain Oracles

2.2. Types of Blockchain Oracles

2.3. Risks of Centralized Providers: Limitations and Challenges

2.4. Decentralized Alternative to Mitigate Centralization Risks

2.5. Proprietary Data vs. Decentralized Data Needs in the Blockchain Ecosystem

2.6. Incentivizing Accuracy: Economic Models in Decentralized Oracles

2.7. Impact of Inaccurate Price Feeds on Blockchain Protocols

2.8. Use Cases of Blockchain Oracles

2.9. Emerging Applications for Blockchain Oracles - Blockchain Oracle Landscape

3.1. Current State of Blockchain Oracles

3.2. Chainlink

3.3. Pyth

3.4. RedStone Oracles

3.5. Chronicle

3.6. Switchboard

3.7. Core Similarities and Architectural Differences

3.8. Comparison of Oracle Growth Metrics - Oracle Tokens

4.1. Historical Context of Oracle Tokens

4.2. Utility of Oracle Tokens in the Ecosystem

4.3. Publicly Listed Oracle Tokens: Economic Models, Metrics and Performance - Funding Rounds & Cap Table Insights of Leading Oracles

5.1. Key trends in Blockchain Oracle Funding

5.2. Recent Capital Raises in Blockchain Oracles

5.3. Comparative Analysis of Leading Oracles: Funding History and Valuations

5.4. Market Comparisons

5.5. Unlocking the Future: Capital Investment Requirements for Blockchain Oracles - Future Outlook

6.1. Innovations in Oracle Technology

6.2. Challenges and Threats

6.3. Market Growth and Adoption Trends

6.4. Insights from Leading Oracle Projects

Appendix A: Funding Rounds of Leading Blockchain Oracles

Executive Summary

There is limited value in transacting on a blockchain unless there is the ability to bring in real-world data from external sources, whether that be pricing information or data concerning key world events.

Currently, blockchains are unable to do this natively, which has historically limited their usefulness.

Furthermore, the proliferation of multiple blockchain networks with different technologies and architectural design choices requires the ability to move value and information between these ecosystems. Without this interoperability, blockchain technology remains constrained in usability and effectiveness.

Oracle technologies solve these challenges by enabling verifiable, real-time data feeds from either the external non-blockchain world or from other blockchains to be brought on-chain.

Oracles, today, are enabling a wide range of applications including Decentralized Finance (DeFi) and Bitcoin Decentralized Finance (BTCFi), as well as in gaming, Non-Fungible Tokens (NFTs), and insurance.

Oracles are also supporting the expanding frontier of where blockchain technology is encroaching on use cases that have traditionally been the domain of established off-chain industries, including supply chain and logistics, trade finance, insurance of non-digital assets, trading of securities in both public and private markets, and identity verification.

Financial services is a key area where interoperability is required and presents a barrier to broader blockchain adoption. The proliferation of public and private blockchains, which lack native capabilities for seamless information transfer, complicates this landscape. Oracles play a key role in linking Traditional Finance (TradFi) to DeFi, thereby unlocking new opportunities for integration and innovation.

With the blockchain oracle industry still nascent, reliable metrics to directly track adoption are lacking. Instead, adoption can be measured indirectly through metrics such as the aggregate value of assets secured by oracle networks for DeFi. Currently, DeFi systems lock in approximately $194.39 billion1DeFiLlama, DeFi Overview, data reported on March 18, 2025, https://defillama.com/?volume%3Dfalse%26tvl%3Dtrue%26liquidstaking%3Dtrue%26vesting%3Dtrue, with oracles securing in the region of 43%2DeFiLlama, Oracles Overview, data reported on March 18, 2025, https://defillama.com/oracles# of that total.

As DeFi continues to expand and mature, and with Real World Asset (RWA) tokenization—i.e., the representation of traditional securities such as property, traditional bonds, and equities—projected to reach between $2 trillion and $30 trillion by 2030,3Cointelegraph, Financial institutions will drive RWA tokenization’s trillion-dollar growth, November 15, 2024, https://cointelegraph.com/news/rwa-tokenization-trillion-dollar-growth-driven-financial-institutions# the demand for secure, scalable, and high-performance oracle solutions will inevitably rise. Oracles will play an even greater role in on-chain financial markets, supporting new layers of composability, automation, and risk management in blockchain-based financial systems.

This report seeks to articulate the landscape of oracle technology, examining use cases, adoption, investment and innovative technologies employed. From this, this publication charts out a likely path for the technology’s future direction based on analyzing key trends, frontier use cases and historical success patterns.

Of the $84.69 billion4DeFiLlama, Oracles Overview, data reported on March 18, 2025, https://defillama.com/oracles# in Total Value Secured (TVS) by blockchain oracles, the top five multi-chain providers collectively secure over 80%,5DeFiLlama, Oracles Overview, data reported on March 18, 2025, https://defillama.com/oracles# highlighting the concentrated nature and level of competition among the key players in this industry.

The report primarily focuses on oracles meeting the following criteria: multichain operation across five or more blockchains and securing over $1 billion6DeFiLlama, Oracles Overview, data reported on March 18, 2025, https://defillama.com/oracles# in assets, collectively referred to in this report as “leading blockchain oracles”, assessing their role in shaping the future of decentralized data infrastructure and blockchain-enabled financial systems.

As institutional players, such as BlackRock and Franklin Templeton accelerate the tokenization of traditional financial assets, the demand for secure, decentralized, and high-performance oracle solutions is intensifying.

Despite significant advancements, blockchain oracles continue to face challenges related to data privacy, scalability, and centralization risks.

The shift towards the use of blockchain technology by traditional industries—illustrated by Blackrock and Franklin Templeton’s efforts to tokenize real world assets—presents an opportunity for oracles to evolve and scale, addressing their limitations while enabling the integration of real-world data into blockchain ecosystems. By enhancing interoperability, oracles can help create a more cohesive and robust decentralized infrastructure, ultimately fostering greater confidence and adoption of blockchain technology.

The key to long-term success for oracle projects will be their ability to address challenges such as privacy and regulation, as well as harnessing the unlocks from new frontier technologies such as Machine Learning (ML) and Artificial Intelligence (AI). Zero-Knowledge Proof technology (ZKPs) has demonstrated early promise in solving privacy challenges on-chain and its adoption by oracles is likely to be a key success factor in adoption.

In addition, oracles that are able to expand beyond basic price feeds, advance the programmability of on-chain data, and improve cross-chain interoperability for emerging DeFi, TradFi, and enterprise applications, are likely to experience outsized growth compared to those that do not.

Insights gathered by the authors from industry-leading oracle projects highlight the future trajectory of blockchain oracles and the evolving competitive environment. By examining their innovations and strategic developments, we gain valuable perspectives on the next phase of oracle technology—one that will be foundational to the continued growth and maturation of blockchain-powered financial systems.

Introduction

A blockchain oracle is a foundational infrastructure component that connects external data sources with blockchain networks and smart contracts. These oracles provide off-chain data necessary to execute smart contracts, as blockchain networks are inherently isolated from external data by design and smart contracts cannot natively access real-world information.

Oracles bridge this gap by supplying information that smart contracts and protocols can use to execute actions, such as fetching price feeds, triggering payments, or initiating further contract clauses.

Oracles operate as intermediaries between the blockchain and the outside world. They fetch, verify, and transmit real-world data, enabling smart contracts to make decisions based on real-world events.

This section covers:

1.1. Importance of Oracles in the Blockchain Ecosystem

1.2. Historical Context

1.3. What’s Ahead: A Preview of Oracle Insights

Key Terms in this Section:

Decentralized Applications (dApps): Applications that operate on a decentralized network, utilizing smart contracts to function without a centralized authority.

Decentralized Finance (DeFi): A financial system built on blockchain technology that enables peer-to-peer transactions and services without intermediaries, such as banks.

Decentralized Oracles: A blockchain-based service that retrieves, verifies, and delivers external data to smart contracts using multiple independent sources and data providers.

Real World Assets (RWA): Physical or traditional financial assets, such as real estate, commodities, or securities, that are tokenized and represented on a blockchain.

Smart Contracts: Self-executing contracts with the terms of the agreement directly encoded. They automatically enforce and execute contractual agreements without the need for intermediaries.

Total Value Locked (TVL): Total value locked represents the total amount of assets deposited or staked in a DeFi protocol.

Understanding blockchain oracles is relevant for all participants in the blockchain ecosystem, whether they be investors, developers, founders, as well as participants in traditional financial markets. This is because oracles fundamentally underpin the reliability and functionality of decentralized systems. With an appreciation of how oracles operate and their implications, stakeholders can make informed decisions that enhance the effectiveness of their blockchain applications and contribute to the broader ecosystem.

This report delivers an analysis of leading blockchain oracles, catering to a diverse audience. It is designed to provide insights for investors, developers, and founders navigating the evolving oracle landscape, while also serving as a resource to a broader audience looking to understand these infrastructure components. For newcomers, it presents a structured introduction to fundamental concepts, while experienced industry participants will find advanced insights and forward-looking analysis on the future of oracles.

1.1. Importance of Oracles in the Blockchain Ecosystem

Oracles are important infrastructure components needed for the efficient functionality of decentralized applications (dApps), Decentralized Finance (DeFi), and smart contracts, which are the cornerstones of blockchain technology. Without oracles, blockchain ecosystems would remain siloed, limiting their potential applications. This limitation would hinder the effectiveness of DeFi, tokenized assets, insurance contracts, and various other use cases that require accurate, real-time off-chain data.

Basic Oracle Data Flow Overview

Source: Capital.com

In the DeFi space, services such as lending platforms, derivatives, and stablecoins rely on accurate pricing data provided by oracles. Faulty or manipulated data from an oracle can lead to erroneous decisions in smart contracts, resulting in financial losses, or even systemic collapse. Inaccurate price feeds can expose platforms to extreme volatility, resulting in unnecessary liquidations and potentially devastating financial consequences.

Innovation in oracle technology has established a new paradigm where decentralized systems no longer need to depend on centralized third-party data providers but access a resilient ecosystem where data is sourced from a diverse array of inputs. This advancement fosters greater security, reduces the risk of manipulation, and aligns with the core ethos of decentralization within blockchain.

1.1.1. Oracles in Action: Real-World Applications in DeFi

Oracles play an important role in DeFi applications like Aave and Compound. These platforms depend on oracles for real-time, precise asset valuations, ensuring stability in lending and borrowing markets. By continuously validating and delivering reliable data, oracles help safeguard against market manipulation and the risks posed by stale or inaccurate information. This functionality facilitates seamless transactions and upholds the integrity of the entire DeFi ecosystem, emphasizing oracles’ importance in maintaining operational efficiency and user trust.

The DeFi sector has been growing steadily over the past two years, since the previous bear market, with Total Value Locked (TVL) surpassing $200 billion.7DeFiLlama, Oracles Overview, TVL data for 2025, reported on March 18 , 2025, https://defillama.com/oracles# At its peak in December 2021, the sector recorded a TVL exceeding $250 billion,8DeFiLlama, DeFi Overview of historical data, reported on March 18, 2025, https://defillama.com/?volume%3Dfalse%26tvl%3Dtrue%26liquidstaking%3Dtrue%26vesting%3Dtrue# achieved within just a few years of its inception. As the industry evolves, it is expected to surpass previous all-time highs. The growth of Real World Asset (RWA) tokenization—projected to reach between $2 trillion and $30 trillion by 2030, according to various sources9Cointelegraph, Financial institutions will drive RWA tokenization’s trillion-dollar growth, November 15, 2024, https://cointelegraph.com/news/rwa-tokenization-trillion-dollar-growth-driven-financial-institutions#—signals a major expansion of on-chain financial markets. As blockchain adoption accelerates, the demand for oracles will continue to grow, solidifying their role as a foundational infrastructure layer in the broader digital economy.

1.1.2. Building Trust: The Security Role of Oracles in Blockchain

Oracles enhance user trust within blockchain applications by ensuring data accuracy and integrity. The emergence of decentralized oracles mitigates the risks associated with single points of failure found in centralized data providers. This shift creates a more secure environment, allowing users to engage in transactions with confidence, knowing that the data driving smart contracts is reliable.

How oracles protect against potential financial losses and systemic risks is demonstrated later in this report where we examine the implications of data breaches and inaccuracies.

Future Trends

The landscape of oracle technology is rapidly evolving, with oracles adopting emerging trends such as cross-chain oracles and the integration of artificial intelligence to enhance the data verification processes. These innovations have the potential to expand the capabilities of oracles, allowing for more sophisticated interactions between blockchain networks and off-chain data sources.

1.2. Historical Context

The concept of oracles has evolved alongside blockchain technology, emerging as a necessary solution to the limitations of closed blockchain systems. Initially, blockchains operated in isolation, unable to interact with external data sources. This limitation restricted their functionality and potential applications. However, as the demand for real-world data integration grew—particularly in the DeFi space—the role of oracles became increasingly significant.

Early oracles were often centralized, posing risks related to data integrity and reliability. As the pioneers in the blockchain ecosystem recognized these vulnerabilities, the development of decentralized oracles became a priority, ensuring that data could be sourced from multiple, trustworthy providers. Today, oracles are relevant for enabling a wide range of applications, from lending platforms to automated insurance contracts, and even in supply chain management and gaming.

This evolution highlights not only the important role of oracles in the blockchain ecosystem but also their adaptability in addressing emerging challenges. As the technology continues to mature, oracles will likely play an even more material role in bridging the gap between blockchains and the real world, expanding the possibilities of decentralized applications.

1.3. What’s Ahead: A Preview of Oracle Insights

In the following sections, we will explore the mechanisms behind blockchain oracles, their types, the risks associated with centralized providers, and decentralized alternatives. We will also discuss specific use cases, the current landscape of oracle technology, and future trends in this rapidly evolving field.

2. Understanding Blockchain Oracles

Blockchain oracles function as bridges between blockchain networks and the external world, enabling smart contracts to interact with data outside of the blockchain environment. Since blockchains are inherently closed systems, they cannot directly access external information, such as market prices, weather data, or event outcomes. Oracles solve this problem by securely providing off-chain data to on-chain smart contracts, enabling them to trigger actions based on real-world events or prices.

This section covers:

2.1. Mechanisms Behind Blockchain Oracles

2.2. Types of Blockchain Oracles

2.3. Risks of Centralized Providers: Limitations and Challenges

2.4. Decentralized Alternative to Mitigate Centralization Risks

2.5. Proprietary Data vs. Decentralized Data Needs in the Blockchain Ecosystem

2.6. Incentivizing Accuracy: Economic Models in Decentralized Oracles

2.7. Impact of Inaccurate Price Feeds on Blockchain Protocols

2.8. Use Cases of Blockchain Oracles

2.9. Emerging Applications for Blockchain Oracles

Key Terms in this Section:

Chainlink Risk Management Network (RMN): One of the validation systems for Chainlink services that independently verifies message integrity using off-chain nodes and on-chain contracts, ensuring security by detecting anomalies and pausing operations in case of potential risks.

Verifiable Random Function (VRF): Verifiable Random Function is a provably fair and verifiable Random Number Generator (RNG) that enables smart contracts to access random values without compromising security or usability.

Decentralized Exchanges (DEX): Allows users to trade cryptocurrencies directly with one another without relying on a central authority or intermediary.

Liquid Re-Staking (LRT): A mechanism that enables validators on Proof-of-Stake (PoS) blockchain networks to redeploy their staked assets to secure additional PoS-based chains.

Liquid Staking (LST): A process that allows users to stake their assets while receiving a liquid token representing their staked holdings, enabling them to participate in DeFi activities without locking up their funds.

Traditional Finance (TradFi): Refers to the conventional financial system, including banks, stock markets, and other regulated institutions.

Zero-Knowledge Proofs (ZKP): A cryptographic method that allows one party to prove the truth of a statement to another without revealing any underlying information.

2.1. Mechanisms Behind Blockchain Oracles

2.1.1. Not All Data Requires Decentralization

It is important to note that not all data requires decentralization. While decentralization is important for certain types of data—especially those that impact the integrity and security of smart contracts—some data can be effectively managed through centralized sources. We are elaborating later in the report on which types of data do not necessitate decentralization.

2.1.2. Components of Blockchain Oracles

Blockchain oracles are constructed with various infrastructure layers and data retrieval and transfer mechanisms. The following four components are commonly found in most blockchain oracle systems:

1. Data Retrieval: Oracles fetch external data from various sources such as APIs, IoT devices, or data feeds. These sources could be anything from financial market data, weather conditions, sports scores, or even geographical locations.

2. Data Verification: Users require that data fetched by oracles is accurate. Many oracles use multiple data sources, data providers, or aggregation mechanisms to ensure the data is accurate before passing it on to smart contracts. This verification step is required for maintaining the integrity of blockchain protocols, as smart contracts depend on the data provided by oracles to execute actions.

3. Data Delivery: After verifying the data, the oracle transmits it to the blockchain, where the smart contract processes it. This can trigger specific actions, such as transferring tokens, executing trades, or enforcing predefined conditions.

4. Security and Transparency: To ensure data integrity, many oracles utilize decentralized networks of nodes for verification. While this method mitigates manipulation risks, challenges arise when data is sourced from proprietary systems. An example of proprietary data could be Bloomberg’s Credit Default Swap spread data. In such cases, the oracle must rely on trusted, independent data sources or a transparent verification process, allowing participants to challenge and validate the data through multiple verifiable sources.

This ensures that even proprietary or exclusive data can be trusted and remains transparent, reducing reliance on a single point of authority. As more complex assets are integrated on-chain, the need for such a system becomes necessary to avoid centralization and a single point of failure in the data chain.

API3 Decentralized Oracle Infrastructure

Source: API3 Blog

Additional Mechanisms in Blockchain Oracles

In addition to the core mechanisms outlined above, six other components enhance the functionality and reliability of blockchain oracles:

- Consensus Mechanisms: Some oracles utilize consensus algorithms to establish the validity of data sourced from multiple providers. This can involve a voting system where several nodes must concur on the data before it is transmitted to the blockchain, ensuring a higher level of accuracy and trustworthiness. For example, Chainlink employs a decentralized network of nodes that collectively verify data before it reaches the smart contract.

- Reputation Systems: Implementing reputation scores for data providers helps assess their reliability. Oracles can prioritize data from sources with higher reputation scores, enhancing overall trust in the information being delivered to smart contracts.For example, oracles may use historical performance data to assign scores, favoring providers with a track record of accuracy.

- Data Aggregation: Aggregation techniques compile data from various sources into a single feed, minimizing the impact of any single erroneous data point. This approach not only improves accuracy but also provides a more holistic view of the data landscape.For example, Band Protocol aggregates data from multiple feeds to create a comprehensive data set that smart contracts can rely on.

- Fallback Mechanisms: In scenarios where the primary data source becomes unavailable, fallback mechanisms maintain continuity by switching to secondary data sources. This ensures that the oracle remains reliable and can continue to provide accurate information.For example, if a weather data API fails, an oracle can automatically retrieve data from an alternative API with comparable information.

- Time Stamping: Including timestamps with the data provides context about when the information was retrieved. This feature is particularly important for time-sensitive applications, where the timing of data can significantly affect outcomes.For example, in financial trading applications, having the exact retrieval time of a price ensures trades are executed based on the most up-to-date information.

- Privacy-Preserving Techniques: Utilizing methods such as Zero-Knowledge Proofs (ZKPs) allows for the verification of data without revealing sensitive information. This ensures privacy while maintaining the integrity of the data being provided to blockchain protocols. For example, some oracles implement ZKPs to confirm the outcome of a bet without disclosing the actual details of the bet itself.

- Intersubjective Data: Unlike objective data, which can be directly verified through deterministic means, intersubjective data requires consensus to determine its validity. This type of data is often necessary for blockchain applications, such as governance decisions, prediction markets, and dispute-resolution mechanisms. For example, UMA’s Optimistic Oracle is designed to verify intersubjective data by allowing disputes to be resolved through economic incentives and decentralized participation. Rather than relying on a single source, UMA’s system enables a network of participants to challenge or confirm proposed data, ensuring a robust and flexible approach to verifying subjective claims in a decentralized environment. Another manner to validate intersubjective data is through human interpretation.

2.2. Types of Blockchain Oracles

By design, not all oracles are the same. There are some key design decisions that each oracle provider has made to tailor their solution to meet a specific set of requirements across types of data retrieval, query mechanism, data types, deployment environments, trust mechanisms, levels of centralization or decentralization.

2.2.1. Classification Based on Data Retrieval

- Software Oracles: These are the most common type, gathering data from online sources like APIs, websites, or other digital platforms.

- Hardware Oracles: These are physical devices that gather real-world data from the environment, such as temperature sensors, GPS devices, and seismometers.

- Inbound Oracles: Data is sent from the external world to the blockchain.

- Outbound Oracles: Data is sent from the blockchain to the external world or system.

Varieties of Blockchain Oracles

Source: Phemex

2.2.2. Classification Based on Query Mechanism

- Push-Based Oracles: These oracles actively send data to the blockchain when certain conditions or events occur.

- Pull-Based Oracles: These oracles provide data when requested by a smart contract. They fetch data on demand.

RedStone Oracles Architecture Features

Source: RedStone Oracle Docs

2.2.3. Classification Based on Data Type

- Price Oracles: Specialize in providing asset price feeds (e.g., cryptocurrency prices, commodity prices).

- Event Oracles: Deliver data related to specific events (e.g., weather conditions, sports outcomes).

- Randomness Oracles: Provide verifiable random numbers for applications like gaming or lotteries.

- Aggregation Oracles: Collect data from multiple sources and compute a consensus value, which can improve accuracy and reliability.

2.2.4. Classification Based on Deployment Environment

- On-Chain Oracles: Execute their logic entirely within the blockchain ecosystem, ensuring full transparency.

- Off-Chain Oracles: Rely on external data sources and external computations, which may later be verified on-chain.

- Hybrid Oracles: Combine both on-chain and off-chain processes to balance efficiency, scalability, and trust.

2.2.5. Classification Based on Trust Mechanisms

- Reputation-Based Oracles: Use reputation scores to weigh data sources, helping to identify reliable nodes.

- Multi-Signature Oracles: Require consensus among multiple independent nodes before data is submitted to the blockchain.

- Human Oracles: Rely on human judgment to verify or input data, useful for qualitative or subjective information.

2.2.6. Classification Based on Centralization

- Centralized Oracles: These oracles retrieve data from a single or highly concentrated set of data sources or providers. Relying on a concentrated set or a single data provider presents risks such as exposing smart contracts to potential manipulation, data integrity issues, and a single point of failure.

- Decentralized Oracles: The goal of these oracles aligns with that of public blockchains: to create a trustless system that cannot be manipulated by a single entity or concentrated group of participants. However, while decentralized oracles aim to reduce reliance on a single trusted party, they do not eliminate trust entirely; instead, they distribute it across multiple participants.

2.3. Risks of Centralized Providers: Limitations and Challenges

On the surface, it might seem sufficient for established entities to publish their data directly to the blockchain, allowing protocols to use this single source for their data requirements. These institutions have a wealth of data and an established reputation in the financial industry. However, relying on centralized providers comes with inherent risks.

Centralized systems are vulnerable to single points of failure, potential data manipulation, and the challenge of trust in a non-transparent environment. These issues are particularly concerning in decentralized systems, where the core ethos emphasizes reducing reliance on a single authority and ensuring that no single party can control or manipulate the data.

For example, consider a scenario where a smart contract is designed to execute financial transactions based on financial data provided by a reputed Traditional Finance (TradFi) institution. If this institution’s data feed were compromised or manipulated, the entire system relying on this data could be impacted, leading to potential financial losses, liquidations, or unfair outcomes. In such cases, participants have no recourse to independently verify the integrity of the data.

A real-world example occurred in May 2024 when the New York Stock Exchange (NYSE) experienced a technical issue that led to widespread trading disruptions10NBC News, New York Stock Exchange says technical issue fixed after Berkshire Hathaway incorrectly shown to fall 99%, June 3, 2024, https://www.nbcnews.com/business/markets/new-york-stock-exchange-technical-issue-berkshire-hathaway-halted-rcna155182#. Several major stocks, including Berkshire Hathaway, saw their prices fluctuate abnormally before being halted. The incident was caused by a malfunction in NYSE’s price bands. As a result, traders relying on real-time price data faced significant financial uncertainty, with some executing trades at incorrect prices before the issue was resolved.

Without an independent verification mechanism, market participants relying solely on this centralized data had no way to confirm its accuracy, leaving them exposed to financial risk. The NYSE incident highlights the dangers of relying on a single authoritative data source in financial markets and underscores the need for decentralized validation systems to enhance transparency, accuracy and resilience.

NYSE’s Price Bands Malfunction Impacting Berkshire Hathaway Stock

Source: Business Insider

Later in the report, we examine cases within the blockchain ecosystem where reliance on a centralized oracle in collateralized lending resulted in financial consequences, while also demonstrating that using multiple decentralized oracle providers offers the highest level of accuracy.

2.4. Decentralized Alternative to Mitigate Centralization Risks

To address the limitations posed by centralized data providers, decentralized oracles offer robust alternatives. Decentralized oracles utilize a network of independent nodes or data providers to retrieve, validate, and report data. Instead of relying on a single centralized provider, data is sourced from multiple independent providers, reducing the likelihood of manipulation or error. This network of nodes typically operates under a consensus mechanism, where a majority of the nodes must agree on the accuracy of the data before it is pushed onto the blockchain.

An example of this is Chainlink’s ‘Decentralized Oracle Networks (DONs), which involve a network of independent nodes that retrieve data from a variety of off-chain or on-chain data providers, aggregate it, and present it on the blockchain. This system is designed to prevent any single point of failure and reduces the potential for manipulation.

In contrast, a centralized data provider lacks the checks and balances of a decentralized system. While their data is often reliable, it remains susceptible to human error, biases, and single-party control. If the single data provider were to supply data directly to a blockchain, participants would have to trust the entity’s integrity without the ability to independently verify the data. This centralized trust model contradicts the decentralized nature of blockchain technology. It also introduces risks that decentralized oracles help mitigate.

It is common for DeFi protocols and dApps to integrate more than one oracle provider to distribute risk. By integrating multiple oracles, protocols can reduce reliance on any single source, and improve overall consistency. This approach helps filter out anomalies and ensures that data, such as asset prices, remains accurate and resilient to manipulation.

_______

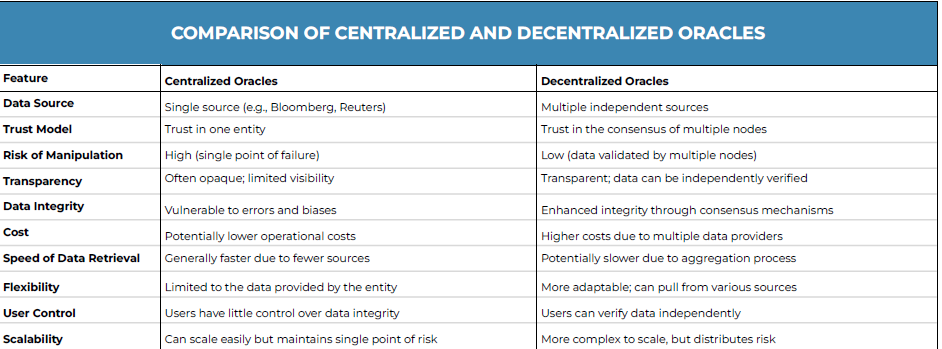

Comparing Centralized and Decentralized Oracles

The following table provides a structured comparison between centralized and decentralized oracles, highlighting key differences and helping illustrate the trade-offs between control and transparency in oracle solutions.

Source: Bering Waters

2.5. Proprietary Data vs. Decentralized Data Needs

in the Blockchain Ecosystem

Proprietary Data in Crypto-Assets

In the ever-evolving world of crypto-assets, not all data needs to be decentralized. In some cases, proprietary single-source data holds value. While decentralized oracles are key for trustless applications that require accuracy and transparency, certain scenarios demand exclusive access to proprietary data, either for competitive advantage or legal compliance.

In custodial services, platforms like Fireblocks, Anchorage, and Copper provide institutional digital asset custodial solutions for institutional clients, including secure key management and contract signing infrastructure. They also track user balances and internal transaction data that may not always be reflected on-chain, highlighting the role of proprietary data in operational efficiency.

Market makers such as Wintermute, Jump Trading, and GSR develop proprietary algorithms to analyze trading volume, order book depth, and arbitrage opportunities across exchanges. Public access to this data would erode their competitive advantage.

Enterprise-grade blockchain networks like Hyperledger and R3 Corda operate with proprietary data structures that ensure confidentiality in regulated environments such as banking, trade finance, and supply chains. These solutions facilitate enterprise-level solutions and private blockchains, where data remains proprietary.

Decentralized Data in Crypto-Assets

On the other hand, decentralized oracles play an important role in providing public, verifiable data for blockchain applications, ensuring transparency and fairness. DeFi protocols rely on decentralized oracles to accurately track asset prices, preventing manipulation and safeguarding financial integrity.

Beyond price feeds, decentralized data solutions support various other applications:

- On-Chain Randomness: Services like Chainlink VRF provide provably fair Random Number Generation (RNG) for gaming, lotteries, and other chance-based applications.

- Cross-Chain Messaging: Bridges like Axelar and LayerZero use decentralized relayers to securely transmit messages across different blockchains, enabling interoperability.

- Real-World Asset Verification: Tokenized assets, such as real estate and stocks, require decentralized verification to prevent reliance on any single entity and maintain trust in asset-backed tokens.

Conclusion

Both proprietary data and decentralized oracles serve distinct yet complementary roles in the blockchain ecosystem.

Proprietary data provides exclusive insights and strategic advantages for platforms that rely on controlled, private information, while decentralized oracles ensure transparency, security, and trust in public blockchain applications. In cases where verifiability and fairness are important, such as DeFi pricing, cross-chain messaging, and real-world asset verification, decentralized infrastructure provides a more robust solution.

The coexistence of both models underscores the need for a nuanced approach, leveraging each where they provide the most value.

2.6. Incentivizing Accuracy: Economic Models in Decentralized Oracles

Decentralized oracle networks rely on carefully designed economic incentive structures to ensure data accuracy and integrity. One common approach is the staking-based model, where node operators are required to lock up tokens as collateral before providing data; for instance, Chainlink has a staking system where operators must stake LINK tokens and risk having a portion of their stake slashed if they submit inaccurate data. RedStone Oracles plans to employ a similar mechanism that penalizes unreliable data submissions. Another model is the Proof-of-Stake system, used by Band Protocol, where token holders vote for validators who stake BAND tokens and risk penalties for dishonest behavior, ensuring accurate data reporting.

The UMA Data Verification Mechanism (DVM) ensures secure, decentralized data verification through an economic incentive model. At its core, it relies on UMA token staking, where participants vote on disputed data, with rewards for honest participation and slashing for dishonest actors. Furthermore, to manipulate the oracle, an attacker would need to acquire the majority of voting UMA tokens, making attacks economically infeasible. Voting participants earn inflationary rewards, reinforcing engagement and security. Combined with staking requirements, this structure aligns token holders’ incentives with the protocol’s integrity, ensuring trustless and tamper-resistant dispute resolution for decentralized applications.

Additionally, the first-party oracle model offers a distinct approach where data providers operate dedicated nodes—such as API3’s Airnodes—to deliver data directly to smart contracts minimizing intermediary risks.

Together, these models create a framework that rewards accurate data provision while penalizing errors or manipulation, ultimately maintaining the reliability and trustworthiness of data feeding into blockchain applications.

2.7. Impact of Inaccurate Price Feeds on Blockchain Protocols

Inaccurate price feeds can pose significant financial risks to blockchain protocols, leading to severe repercussions for users and platforms alike. When price distortions occur, they can trigger unintended liquidations, misprice assets, and create cascading failures across DeFi markets. An example occurred in April 2024, when ezETH, Renzo Protocol’s Liquid Restaking Token, de-pegged, resulting in approximately $60 million in liquidations across leveraged protocols like Gearbox and Morpho Labs.

Triggered by community reactions to the announcement of a REZ token airdrop, the value of ezETH plummeted by as much as 83% against its underlying ETH asset. Within less than an hour, prices in a low-liquidity, high-slippage Uniswap pool dropped to as low as $688, while more liquid pools on Balancer and Curve reflected values around $2,500 compared to that of ETH’s actual market value, which remained above $3,000. This disparity arose from some oracle providers reporting distorted prices due to maladjusted weights in trading pools.

Performance of Chainlink and RedStone Oracles

During this period of volatility, both Chainlink and RedStone Oracles demonstrated greater efficiency compared to other providers. The two oracles effectively captured the market realities more effectively by leveraging robust aggregation models and real-time adjustments.

RedStone Oracles and Chainlink’s Performance during ezETH de-Peg

Source: ezETH de-peg analysis

Additionally, RedStone Oracles exhibited a faster response time, as illustrated below. By leveraging slippage monitoring and median-based aggregation methods, RedStone mitigated extreme price swings, maintaining a more stable price above $2,960 throughout the event.11RedStone Docs, Renzo $ezETH Temporary de-peg, April 24, 2024, https://docs.google.com/document/d/1sRkwTsqc_rx77-bcfoYyxTANP5dlZSx9l3uxwfElUxE/edit?tab%3Dt.0%23heading%3Dh.lil37rqcogsd#

While no oracle can completely eliminate volatility, this event underscores the importance of oracles with built-in redundancies and adaptive pricing mechanisms to ensure greater stability in blockchain systems.

Another example of inaccurate price feeds impacting blockchain protocols occurred in November 2020 when Compound, a leading DeFi lending protocol, experienced mass liquidations totaling over $89 million due to an oracle exploit.12Decrypt, Oracle Exploit Sees $89 Million Liquidated on Compound, November 26, 2020, https://decrypt.co/49657/oracle-exploit-sees-100-million-liquidated-on-compound# The issue stemmed from a sudden, inaccurate spike in the reported price of DAI on Coinbase, which was used as a data source for Compound’s price oracle. The artificial price surge triggered significant liquidations of users’ collateralized positions.

Impact of Inaccurate Price Feeds on Compound

Source: Decrypt

These incidents highlight the role of reliable oracles in DeFi protocols. If a price oracle fails to deliver accurate, real-time market data, it can result in cascading liquidations and undermine trust in the protocol. To mitigate such risks, many blockchain protocols have since adopted more robust price aggregation mechanisms, such as median-based pricing models, which reduce the impact of outliers and multi-source data verification, to ensure the integrity and stability of their oracle-reliant systems.

2.8. Use Cases of Blockchain Oracles

Oracles extend beyond price feeds, enabling applications in DeFi, gaming, insurance, asset tokenization, and cross-chain interoperability. This section covers seven key applications and their role in blockchain infrastructure, followed by emerging use cases.

1. DeFi: In the DeFi sector, oracles provide real-time pricing data for digital assets, collateral management, and executing trades on Decentralized Exchanges (DEXs). Oracles have become fundamental in providing price feeds for tokens, stocks, commodities, and other assets. They play a pivotal role in various applications:

i) Decentralized Lending and Borrowing: Platforms, such as Aave and Compound, use oracles to obtain accurate price feeds for diverse assets. These feeds are crucial for assessing collateral values, calculating loan-to-value ratios, and ensuring algorithmic interest rate models function effectively. By preventing under-collateralization and triggering necessary liquidations, oracles maintain the stability and security of these platforms.

Oracle Function in Decentralized Lending and Borrowing

Source: ResearchGate

ii) DEXs: Oracles provide real-time price feeds, ensuring that assets are accurately priced and trades are executed at the correct prices. This data is integrated into smart contracts, allowing DEXs to maintain liquidity pools, and ensure transparent and efficient trading.

iii) Stablecoins: Oracles supply the necessary data for stablecoins to maintain their pegs. For example, MakerDAO13The Block, MakerDAO Integrates Chainlink Oracle to Help Maintain DAI Stability, February 9, 2023, https://www.theblock.co/post/210229/makerdao-integrates-chainlink-oracle-to-help-maintain-dai-stability# relies on Chainlink to manage its DAI stablecoin, which is pegged to the US dollar.

iv) Liquid Staking (LST) and Restaking (LRT): Oracles also price staking derivatives, such as stETH from Lido.14RedStone Oracles Blog, Case Study: RedStone Propelling DeFi with Lido’s stETH Price Feed, July 6, 2023, https://blog.redstone.finance/2023/07/06/case-study-redstone-oracles-propelling-defi-with-lidos-steth-price-feed# RedStone Oracles’ price feed for stETH is fundamental to enabling external protocols to price the token correctly as collateral or in other DeFi contexts.

v) Synthetic Assets: Oracles enable the creation of synthetic assets by providing and pegging the underlying asset to real-world data feeds. For example, Synthetix15Synthetix Docs, https://developer.synthetix.io/tokens/#—a decentralized synthetic asset issuance protocol—relies on Chainlink to obtain accurate price feeds for various assets, ensuring the proper valuation of synthetic assets.

Oracle Function in Synthetic Assets

Source: ResearchGate

vi) Perpetual Contracts: Oracles facilitate the accurate pricing and settlement of perpetual futures contracts. For instance, Drift Protocol,16Drift Protocol X (former Twitter): Migration to Pyth – Announcement, June 27, 2024, https://x.com/DriftProtocol/status/1806360865006064068# a decentralized perpetual exchange on Solana, leverages Pyth and Switchboard to access high-frequency market data, enabling efficient trade execution and liquidation processes.

2. Prediction Markets: Oracles enable smart contracts to execute functions based on real-world events. These contracts can trigger automatic payments, initiate processes, or record data as certain conditions are met. For example, decentralized prediction market platforms utilize oracles to feed real-world event outcomes into its smart contracts. By aggregating data from multiple trusted sources, these oracles verify the results of predictions—such as election results or sports scores—allowing the platform’s smart contracts to settle markets accurately and fairly.

Polymarket stands as one of the industry’s most established and widely recognized prediction markets, and it is also the most liquid. The platform has gained significant influence during major global events such as the 2024 U.S. Presidential Election, where over $3.6 billion17Polymarket, Presidential Election Winner 2024, November 5, 2024, https://polymarket.com/event/presidential-election-winner-2024/will-kamala-harris-win-the-2024-us-presidential-election# in wagers were placed.

Polymarket: 2024 U.S. Elections

Source: Polymarket

While Polymarket is designed to be oracle-agnostic, UMA is the exclusive oracle used for resolving markets on the platform. Since February 2022, UMA’s Optimistic Oracle has powered Polymarket’s outcome verification, securing over $3.6 billion in market volume during the 2024 U.S. Presidential Election. When a market is created, a request is automatically sent to UMA’s oracle. If the proposed outcome goes undisputed, it is accepted. In the case of a dispute, resolution escalates to UMA’s DVM, where UMA token holders vote to determine the final result.18Polymarket Docs, https://legacy-docs.polymarket.com/polymarket-%2B-uma#

Further strengthening this partnership, UMA, Polymarket, and EigenLayer have announced a collaboration to build the next-generation oracle for prediction markets, aiming to enhance security and efficiency in decentralized forecasting platforms.

3. Blockchain Interoperability: Interoperability infrastructure enables different blockchain networks to communicate and share data seamlessly. Oracles act as a bridge between these closed systems, ensuring that information from one chain can be accurately and securely transmitted to another. As blockchain protocols evolve into integrated solutions across multiple chains, interoperability becomes essential for their scalability, their ability to tap into different user bases, and tapping into liquidity on other chains

.

Interoperability between Blockchains

Source: Deloitte Article

An example of interoperability is Chainlink’s Cross-Chain Interoperability Protocol (CCIP). CCIP uses multiple decentralized oracle networks, including an independent Risk Management Network (RMN), to facilitate cross-chain communication by securely transferring data and assets between different blockchain networks. This approach allows protocols to access data from multiple chains and execute operations across various platforms without relying on centralized intermediaries.

4. Supply Chain Management: Oracles play a role in tracking the movement and status of goods as they pass through various stages of the supply chain. Traditional supply chain management often relies on centralized systems, resulting in inefficiencies, fraud risk, and a lack of transparency. By integrating blockchain technology with oracles, businesses can enhance traceability, automate processes, and ensure data accuracy across the entire supply chain.

One use case for oracles in supply chain management is the real-time tracking of goods, from raw materials to finished products. Oracles can fetch data from various external sources such as GPS systems, temperature sensors, and barcode scanners, feeding this information into smart contracts to trigger specific actions based on predefined conditions. This creates an immutable record of each step in the supply chain, facilitating the verification of goods’ authenticity and condition of goods.

For example, VeChain, a Layer 1 blockchain ecosystem, aims to enhance supply chain management and business processes, by using oracles to track the movement and condition of products in real-time. VeChain integrates Internet of Things (IoT) devices such as Radio Frequency Identification (RFID)19A wireless technology that uses electromagnetic fields to automatically identify and track tags attached to objects. tags, sensors, and Quick Response (QR) codes to collect and transmit real-time data about products’ journeys through the supply chain.20Dia Oracle Dashboard, VeChain (VET) API and Price Oracle, https://www.diadata.org/app/price/asset/VeChain/0x0000000000000000000000000000000000000000/# This data is then recorded on the blockchain, creating an auditable trail for verification and tracking.

The oracle ensures that real-time data from sensors and GPS systems is accurately fed into smart contracts, which can trigger actions like notifying stakeholders about delays or temperature deviations that could compromise product integrity.

VeChain Supply Chain Overview

Source: VeChain Blog

Another notable example is IBM Food Trust,21IBM, Food Logistics on Blockchain, https://www.ibm.com/blockchain/resources/food-trust/food-logistics/# a blockchain-based platform aimed at enhancing the transparency and traceability of food supply chains. Utilizing Hyperledger Fabric as its blockchain infrastructure, IBM Food Trust leverages IoT devices, direct data input, and APIs from supply chain participants to collect real-world information, such as product origin, shipping status, and quality control information. This approach allows stakeholders—such as farmers, manufacturers, and retailers—to verify the journey of food products from farm to table, ensuring food safety and quality throughout the supply chain.

Food Supply Chain Overview

Source: Kiosk Marketplace & Vending Times

5. Insurance: Oracles enable the automation of claims processing by providing real-time, verifiable data. Traditional insurance models often rely on manual claims assessments, which can be slow and error-prone. By integrating oracles into insurance smart contracts, the entire process can be streamlined and more transparent, reducing inefficiencies.

One of the primary use cases of oracles in insurance is parametric insurance22A type of insurance that automatically issues payouts based on predefined triggers, such as weather events or market conditions, rather than assessing actual losses. where smart contracts automatically trigger payouts based on predefined conditions linked to real-world data. For example, weather-based parametric insurance policies can be triggered by data from oracles that track weather events such as hurricanes, floods, or rainfall levels. If the data shows that a specific threshold (e.g., wind speed or rainfall amount) has been exceeded, the smart contract executes a payout to policyholders without requiring human intervention. This approach reduces the time and administrative burden typically associated with traditional claims processing, which can take weeks or even months.

Otonomi, a parametric cargo delay insurance solution provider, uses oracles for real-time, external data, which is an important component of its infrastructure. By integrating weather and logistics data from trusted sources, Otonomi can automatically assess and trigger claims based on predefined conditions, ensuring quick and transparent payouts.

Otonomi Oracle Infrastructure

Source: Chainlink Case Study (Otonomi)

Another notable example is flight delay insurance, where oracles track flight data from trusted sources such as aviation authorities or airport APIs. If a flight is delayed beyond a certain threshold, the oracle updates the smart contract with this real-time data, triggering an automatic payout to the policyholder. This eliminates the need for manual claims submission and approval.

Etherisc, a decentralized insurance platform, offers flight delay insurance powered by Chainlink. It utilizes Chainlink23Chainlink Blog, Supporting the Development of Blockchain-Based Insurance Solutions Through the Chainlink-Etherisc Joint Grant Program, March 11, 2022, https://blog.chain.link/chainlink-etherisc-joint-grant-program/# to provide real-time flight data—such as delays and cancellations—from trusted sources like aviation authorities and airline APIs. The smart contract automatically triggers payouts to policyholders when flights are delayed beyond a specified threshold.

Chainlink Insurance Infrastructure

Source: Chainlink Use Cases (Insurance)

6. Gaming and NFTs: Oracles observed a momentum in the gaming and NFT sectors, enabling real-world data to enhance interaction and the functionality of these digital ecosystems.

In gaming, oracles can power in-game economies, trigger in-game events based on real-world conditions, and even ensure the randomness and fairness of outcomes.

For example, Axie Infinity, a well-known blockchain-based game, uses oracles for game mechanics that depend on randomness, such as breeding mechanics and battles. These mechanisms are important to the game’s play-to-earn model and require fair Random Number Generation (RNG). By integrating Chainlink’s Verifiable Random Function (VRF),24Chainlink Ecosystem, Axie Infinity Integrates Chainlink Oracles!, November 16, 2020, https://www.chainlinkecosystem.com/ecosystem/axie-infinity# Axie Infinity ensures that the outcomes of these mechanics are verifiable and immutable, which also helps secure trust in the game’s economy and gameplay.

In the world of NFTs, oracles facilitate the authenticity, provenance, and price verification of digital assets. They can feed off-chain data into NFTs, such as confirming the real-world event or item that an NFT represents, or dynamically adjusting the value of the NFT based on external market conditions.

7. Identity and KYC: Oracles play a key role in verifying individuals’ identities in dApps and blockchain protocols that must comply with legal frameworks like Know Your Customer (KYC) and Anti-Money Laundering (AML). They streamline this process by fetching identity data from trusted sources, such as government databases, banks, or digital identity providers. As the industry matures and more institutional clients participate in blockchain ecosystems, the need for strict KYC and AML protocols increases. Oracles will be essential in integrating identity verification into dApps, a trend expected to grow in response to rising regulatory pressures.

Other Blockchain Oracle Use Cases

In addition to the established use cases for blockchain oracles illustrated above, several other potential applications are emerging.

These include facilitating secure voting systems, managing healthcare data, and enabling decentralized energy trading. Additionally, oracles can play a crucial role in legal contracts, and real estate transactions. The versatility of blockchain oracles in connecting smart contracts with real-world data highlights their importance across various sectors, driving innovation and improving efficiency in numerous applications.

2.9. Emerging Applications for Blockchain Oracles

In 2024, there was an increase in blockchain adoption activity by TradFi institutions. From the approval of BTC and ETH ETFs to major players like BlackRock entering the space, substantial advancements have emerged.

2.9.1. RWA Tokenization

Notable announcements by TradFi participants have included both pilots as well as real-world launches of tokenized financial assets on JPMorgan’s Onyx Platform (recently rebranded Kinexys), and HSBC’s Digital Vault for Tokenized Assets (Orion). Outside of tokenization, DBS Bank launched a Trade Finance platform based on blockchain technology.

The fact that these institutions have moved from piloting to actual launching of blockchain-enabled platforms that facilitate trade and investment using RWA demonstrates that TradFi in 2024 has moved away from experimentation and concluded that blockchain and digital asset infrastructure has a meaningful place in traditional financial services infrastructure.

As these institutions evolve, new use cases for oracles are emerging within the financial services sector, particularly in providing data feeds for pricing real-world assets and enhancing interoperability. The RWA market, which involves bringing real assets such as private credit, US treasury debt, commodities, institutional alternative funds, among other assets on-chain in tokenized form, is worth over $18.6 billion,25rwa.xyz, Global Market Overview, data reported on March 18, 2025, https://app.rwa.xyz/# and is projected to reach between $2 trillion and $30 trillion by 2030, according to various sources.26Cointelegraph, Financial institutions will drive RWA tokenization’s trillion-dollar growth, November 15, 2024, https://cointelegraph.com/news/rwa-tokenization-trillion-dollar-growth-driven-financial-institutions# According to data from RWA.xyz, the RWA tokenization sector has over 85,000 total asset holders, with approximately 150 different asset issuers.

Total RWA On-Chain Value

Source: rwa.xyz

The tokenization of RWAs offers numerous benefits, including greater access to liquidity, enhanced price discovery, lower settlement risk, and reduced friction and costs in asset issuance. Oracles will play a crucial role in tokenizing real-world assets such as real estate, equities, and commodities. They provide accurate pricing data and facilitate the verification of asset ownership and related documentation, enabling smoother transactions and better liquidity in the market.

Oracles are required both for fully on-chain assets (primarily for price discovery and locating liquidity) and for bridging with the off-chain world. For example, a tokenized real estate fund may have underlying documents such as property deeds and permit approval documents.

Today, in the United States, the National Best Bid and Offer (NBBO) regulation ensures stock brokers execute trades at the best price available. As traditional assets start to become traded in a broader set of trading venues than the traditional monolithic exchange, an NBBO construct—whether it is required by law or demanded by brokers to obtain the best pricing—will be increasingly important to ensure that customers can benefit from the best value. Oracles play an important role in aggregating data from a range of venues to be able to support price transparency.

2.9.2. Challenges for Oracles with RWA Tokenization

However, the application of oracles in RWA tokenization faces challenges. Ensuring data integrity is crucial; inaccuracies can lead to substantial financial repercussions. Depending on third-party data raises concerns about reliability, especially in sectors like real estate, where valuations can vary due to different appraisal methods.

Integrating oracles with legacy systems complicates data flow and increases costs. Regulatory compliance is another concern, as varying laws complicate oracle use in finance and insurance, where oversight is stringent. Transparency in oracle operations is essential for building trust; a lack of clarity can hinder acceptance.

Finally, fragmented standards in the oracle ecosystem can limit interoperability and affect liquidity. These challenges highlight the need for continuous innovation in oracle technology to fully realize the potential of RWA tokenization across various sectors.

2.9.3. Interoperability in Financial Services

Another emerging use case for oracles concerns interoperability for traditional institutional players using digital assets. The proliferation of platforms and protocols has fragmented the market, creating a hurdle for institutional adoption. Digital assets become limited to silos of small ecosystems of buy-side and sell-side market infrastructure institutions that have standardized on a particular platform, restricting their ability to participate in others.

This challenge presents an opportunity for oracles to evolve from merely providing asset data to providing a mechanism to support interoperability. As the blockchain landscape expands, oracles will enable seamless data transfer and communication across different blockchain networks, facilitating cross-chain transactions and enhancing the overall functionality of decentralized applications. Interoperability is becoming the key to institutional adoption of financial services by abstracting away the choice of issuance platform or blockchain “rail.” This relegates it to invisible plumbing, enabling institutions to connect their systems—whether order management systems or settlement infrastructure—to the on-chain world.

Chainlink CCIP is a key player in the space, having conducted interoperability pilots with SWIFT27Swift News, UBS Asset Management, and Chainlink successfully complete innovative pilot to bridge tokenized assets with existing payment systems, November 5, 2024, https://www.swift.com/news-events/press-releases/swift-ubs-asset-management-and-chainlink-successfully-complete-innovative-pilot-bridge-tokenized-assets-existing-payment-systems# , UBS, and Euroclear. Additionally, Ownera, while branding itself as an interoperability solution rather than an oracle, uses an oracle-based approach to support interoperability.

Ownera, HQLAᵡ, J.P. Morgan, and Wematch have successfully demonstrated the technical feasibility of executing a Delivery-versus-Payment (DvP) repo transaction—a mechanism ensuring that the transfer of securities occurs simultaneously with the payment—across two Distributed Ledger Technology (DLT) platforms at HQLAᵡ and J.P. Morgan.

The demonstration showed how rights to securities, recorded in Digital Collateral Records (DCRs) on the HQLAᵡ ledger, and digital cash, recorded at J.P. Morgan, could be recorded and transferred using two different DLT platforms.

The simulated transaction was negotiated in the Wematch trading front-end. Ownera connected Wematch and the two distributed ledgers using the open-source Financial Protocol for Peer-to-Peer (FIN P2P) routing protocol, ensuring the visibility of assets in Wematch and coordinating the DvP settlement across the HQLAᵡ and J.P. Morgan platforms.

Chainlink CCIP spans both institutional RWA and traditional cryptocurrency, providing support for the cross-chain transfer of value (e.g., ETH between different protocols).

2.9.4. Conclusion

While adoption by financial services institutions has been slow to take off, the dynamics of private capital—which in recent years has taken over as the thematic investment preference from public markets—signal a significant opportunity. By harnessing the efficiencies of digital assets, the fragmented and inefficient market landscape can be transformed, paving the way for greater innovation and integration within the financial sector.

3. Blockchain Oracle Landscape

The blockchain oracle landscape has become increasingly competitive, with multiple providers offering diverse solutions tailored to different market needs. The space continues to evolve rapidly from established players such as Chainlink and Pyth securing billions in total value to emerging protocols such as RedStone Oracles and Switchboard introducing novel architectures.

Each blockchain oracle operates with its unique architecture. While we have standardized key components for analysis, not all aspects are directly comparable, as each oracle is designed with specific mechanisms and priorities tailored to its use case.

This section provides a comparative analysis of the leading oracle networks, their core architecture, and how they differentiate in terms of scalability, security, and interoperability.

This section covers:

3.1. Current State of Blockchain Oracles

3.2. Chainlink

3.3. Pyth

3.4. RedStone Oracles

3.5. Chronicle

3.6. Switchboard

3.7. Core Similarities and Architectural Differences

3.8. Comparison of Oracle Growth Metrics

Key Terms in this Section:

- Total Value Secured (TVS): Total value secured measures the total financial value of assets that depend on a blockchain oracle for accurate data.

- Latency: The delay between the initiation of a request and the delivery of the corresponding response, often measured in milliseconds.

- Ethereum Virtual Machine (EVM): The decentralized computing environment that executes smart contracts on the Ethereum blockchain and Ethereum-compatible networks.

- Time-Weighted Average Price (TWAP): A trading metric that calculates the average price of an asset over a specified time period, helping to reduce the impact of market volatility on large trades.

- Liquidity-Weighted Average Price (LWAP): A pricing method that calculates an asset’s average price over a given period, weighted by the available liquidity at different price levels.

3.1. Current State of Blockchain Oracles

The expansion of the blockchain oracle market is evident in its Total Value Secured (TVS), which, in 2025, has oscillated around approximately $100 billion across more than 50 oracles—nearly doubling from approximately $50 billion in January 2024. This surge reflects rising trust and adoption as oracles secure a greater share of DeFi’s value.

Additionally, the TVS-to-Total Value Locked (TVL) ratio offers insight into the efficiency and utilization of secured assets within the ecosystem, underscoring the expanding role of oracles within the broader blockchain infrastructure. Today, based on commonly used aggregators, the TVS-to-TVL ratio stands at 0.43, with a TVS of $84.69 billion28DeFiLlama, Oracles Overview, data reported on March 18, 2025, https://defillama.com/oracles# and a TVL of $194.39 billion.29DeFiLlama, DeFi Overview, data reported on March 18, 2025, https://defillama.com/?volume%3Dfalse%26tvl%3Dtrue%26liquidstaking%3Dtrue%26vesting%3Dtrue# It is important to note that the TVS reported by selected oracles is higher than that reported by the aggregator; therefore, this ratio might be higher.

Chainlink continues to dominate the market, commanding over 50% of the market share, followed by Pyth, Chronicle, and RedStone. Collectively, the top five blockchain oracles account for approximately 80% of the aggregate value of assets secured by all oracles, highlighting the concentrated nature and intense competition among the key players in this industry.

The following section aims to dive deeper into the architecture and examines the unique features of some of the leading oracles in the industry.

Each blockchain oracle is built with its distinct architecture and operational mechanisms, making direct comparisons complex. While this report standardizes key components for structured analysis, it is important to recognize that not all aspects are directly comparable. Each oracle is designed to fulfill specific use cases with varying approaches to data aggregation, validation, security, and delivery. Readers should consider these nuances when interpreting the comparisons, as differences in features influence the strengths, trade-offs, and ideal applications of each oracle solution.

Comparison of Blockchain Oracle Features

The comparison table below highlights the architectural differences among leading oracle solutions, including Chainlink, Pyth, RedStone Oracles, Chronicle, and Switchboard, showcasing their core mechanisms, differentiation methods, and relevant metrics

Source: Bering Waters

3.2. Chainlink

Chainlink is the largest and most widely adopted blockchain oracle network, with over 50% of the market share in TVS across DeFi, institutional finance, and tokenized assets. Chainlink provides multiple services that extend beyond basic price feeds, enabling interoperability, proof of reserves, and identity verification. Chainlink is set to introduce a major architectural upgrade with the Chainlink Runtime Environment (CRE). This innovation will enable developers to design and deploy custom DONs workflows across data, compute, and execute interoperable seamless integrations across all blockchain ecosystems.

Chainlink’s infrastructure is built around the following models that address the varying needs of users:30Chainlink Blog, The Three Requirements of Tokenized Real-World Assets (RWAs) Solved by Chainlink, October 26, 2023, https://blog.chain.link/stages-enriching-real-world-assets/#

1. Data Feeds and Market Information: Chainlink Data Feeds aggregate and deliver financial data across commodities, equities, forex, economic indicators, and cryptocurrencies. The oracle provides 1,000+ price feeds from 25+ data providers. Chainlink offers both push, as well as hi-performance pull feeds, depending on the nature and needs of the application integrating them.

2. Proof of Reserve (PoR): Provides automated, real-time verification of asset reserves backing tokenized RWAs and stablecoins. This enhances transparency and risk management by enabling smart contracts to trigger circuit breakers if discrepancies arise between off-chain reserves and on-chain token balances.

3. Chainlink Functions: A serverless developer platform for fetching data from any API and running custom computation using Chainlink’s secure and reliable network. Any off-chain event or data can be synchronized or published on-chain, such as standing settlement instructions, corporate actions, proxy voting, Environmental, Social and Governance (ESG) data, dividends, interest, and Net Asset Value (NAV).

4. Decentralized Identity: Chainlink acquired privacy-focused oracle solution DECO from Cornell University. DECO leverages ZKP to verify identity and asset ownership without exposing sensitive information. This is critical for institutions needing to meet regulatory compliance requirements while maintaining privacy on public blockchains.

5. Cross-Chain Interoperability with CCIP: The Chainlink Cross-Chain Interoperability Protocol serves as a universal messaging and token transfer standard, enabling assets and data to move securely across multiple blockchain networks. CCIP functions as an abstraction layer that eliminates the need for institutions to integrate with individual chains, reducing time and costs.

6. Chainlink CRE: The Chainlink Runtime Environment (CRE) is a major upgrade that modularizes DONs, enabling developers to create custom workflows across data, compute, and interoperability. By executing code on CRE instead of on-chain, developers can build faster, integrate seamlessly across all blockchains, and deploy financial applications with built-in compliance and privacy features.

Chainlink Infrastructure Overview

Overall Oracle Architecture

- Data Sources: Chainlink integrates with a variety of external data providers, such as authenticated APIs, financial exchanges, IoT devices, and legacy enterprise systems to gather off-chain data.

- Decentralized Consensus: Chainlink’s decentralized network of nodes works together to ensure that data is validated and aggregated securely. This consensus ensures that the data sent to smart contracts is consistent and tamper-proof. With Offchain Reporting (OCR), nodes communicate through a peer-to-peer network, aggregate data off-chain using a lightweight consensus algorithm, and submit a single signed transaction on-chain. This improves scalability, reduces gas costs, and maintains the trustless security of Chainlink’s oracle network.

- Staking and Incentives: Chainlink uses staking as an incentive mechanism for node operators, to ensure they act honestly. If a node behaves maliciously or fails to deliver accurate data, it loses its stake, providing an additional layer of security to the oracle network.

3.3. Pyth

Pyth is one of the leading multi-chain oracles in the market. Pyth launched on Solana in 2021 and has since expanded to more than 93 blockchains. Pyth also boasts the highest number of data providers, with over 124 such providers.

Unlike traditional push oracles, Pyth allows for permissionless price updates. Pyth’s data providers submit data and interact with the on-chain contract, which is then combined by the oracle program to produce a single aggregate price and confidence interval. This system enables applications to utilize a single transaction flow that first updates the price and then executes the required application logic, making Pyth suitable for clients seeking real-time price feeds in DeFi and other protocols.

Overall Oracle Architecture31Pyth Docs, Design Overview, https://docs.pyth.network/price-feeds/how-pyth-works#

Pyth’s infrastructure is built around four key components: Data Publishers, Pull Oracles, Pythnet, and the Oracle Program. These components work together to aggregate, validate, and deliver price data to multiple blockchain ecosystems while maintaining decentralization and transparency.

- Data Publishers: Contribute pricing information to Pyth’s oracle program. These publishers come from a wide range of sources, such as financial institutions, exchanges, and market makers.

- Pull Oracles: In this model, prices are updated only when requested, unlike the Push model where oracles periodically update the price feeds. This offers several advantages, including higher update frequencies and lower latency. With pull oracles, smart contracts do not need to store prices and wait for periodic updates; instead, they request the latest price on demand, which is then sent to the blockchain in a single transaction.